by doForms

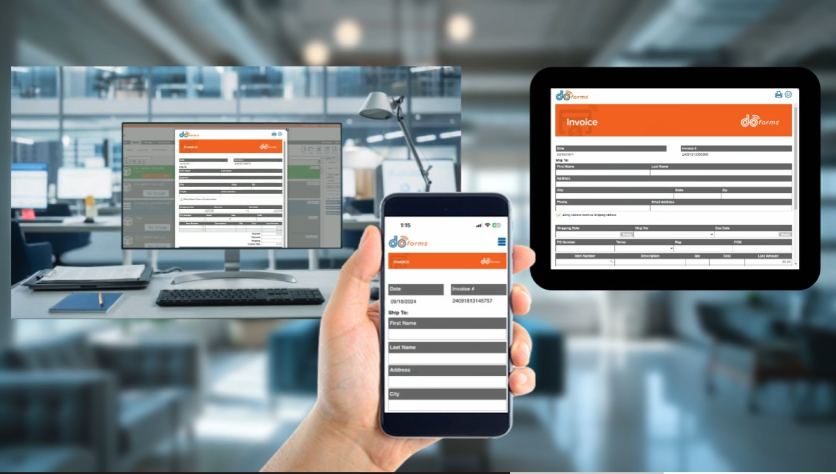

Our forms incorporate your rules, calculations, and logic to ensure good data integrity, ease of use and a reduction in time spent communicating with all aspects of your organization.

WorkFORCE is based on a very simple concept – our forms can modify data in sources kept on the cloud and can retrieve data from those sources as well.

WorkFORCE automates your organization by offering real -time job dispatch and form forwarding

Workforce allows you to create custom tile-based dashboards and our forms can send data in real-time so that the dashboard tiles always have current data.

"Moving to doForms allowed us to streamline work order communications from building and maintenance crews to the back office. The efficiencies gained have translated to significant and ongoing cost savings, as well as more responsive business operations and more satisfied clients."

"The thing that really blew me away was the ability to build my own forms. It’s an added benefit to be able to update these forms on a moment’s notice. It’s gotten to where it now takes me about 2 hours to build a form. You know, it’s fun. And when you’re doing something that’s fun, it’s easy to do."

Les meilleurs casinos en ligne offrent des jeux de qualité, un support client professionnel et des paiements rapides.

Accédez à l'excellence du gaming français sur https://vegasino.fr – votre palace virtuel Vegas où chaque spin vous rapproche de l'extase des gains légendaires du Nevada.

Visitez penalty-shoot-out.fr pour une expérience de penalty virtuel authentique avec des effets sonores de stade et une ambiance de match en direct immersive.

"For such a powerful tool, the software is extremely simple in nature. Within 30 days, the bulk of our drivers, having not used smartphones prior and working on a 100 percent paper basis, were up to speed and using the forms properly. The fact is, doForms has significantly influenced our operational productivity."